The major holders of a particular cryptocurrency are called “Whales,” The number of bitcoin “whales,” or holders of over 1,000 BTC, has increased by 17% in 2020, according to blockchain forensics firm Chainalysis.

The Crypto industry likes to keep track of these statistics because they represent deep conviction and/or institutional stakes. A higher number of large holders does also introduce some centralization through concentration of wealth, and the risk that any one of these holders could sell, pushing the market down. This is especially true of altcoins with small market caps compared to the Bitcoin market cap.

Bitcoin is the big dog in the crypto world, and altcoins in general follow the trend set by Bitcoin. There are whales for altcoins, too, and the average retail investor is somewhat at the mercy of a whale sell-off.

ANALYSIS PROVES…

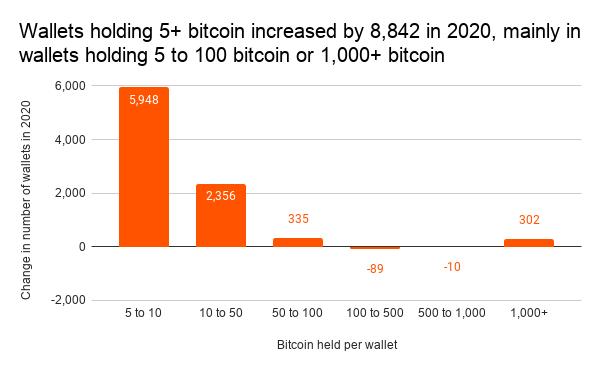

An average investor’s wallet contains less than one whole Bitcoin. We know this to be true because the Bitcoin blockchain is entirely transparent– we can view every transaction in the public ledger. We have evidence of a significant rise in the number of wallets containing 5 or more Bitcoins. The analysis in this graph shows that the number of wallets that hold 5-10 BTC had increased by a considerable amount in 2020:

(Source: Chainalysis)

2020 was crypto’s biggest year yet. What do you think 2021 will be for crypto? Whatever the whales do, we’re in this for the long-term, expecting greater returns this year and into the future. Remember, there are thousands of altcoins in addition to Bitcoin– we expect even greater returns in the form of Ether and several other cryptocurrencies.

It’s not too late to get in the game. Decide to take action, learn what you need to know about crypto, and become successful. Be A Cryptoan! We welcome you to Join us now by registering for free.